What Politics Looks Like Today and Why

Collapse is linked to diminishing resources – less energy, less food, less minerals, fewer workers.

For developed, industrial economies, this collapse will occur when we lose access to (cheap) energy and minerals (iron ore, copper, sand, nickel, cobalt etc.) which impact our ability to make ‘stuff’ (cheaply). Most developed countries also have ageing or even declining populations, which, in the absence of large-scale immigration, leads to a noticeable decline in labour.

These effects are exacerbated by an ever-greater demand for materials and labour to maintain living standards. For example, climate change related destruction of infrastructure (buildings, roads, bridges, power lines etc.) brings about increased costs to maintain the appearance of growth and prosperity.

This is a long-winded introduction to the question of why politics and politicians today seem so inept, in the sense that they keep promising the world, as before, but delivering next to nothing. Trust in politicians is at all-time lows in most developed countries and this disconnect between promises and lack of delivery for normal people is at the heart of the distrust.

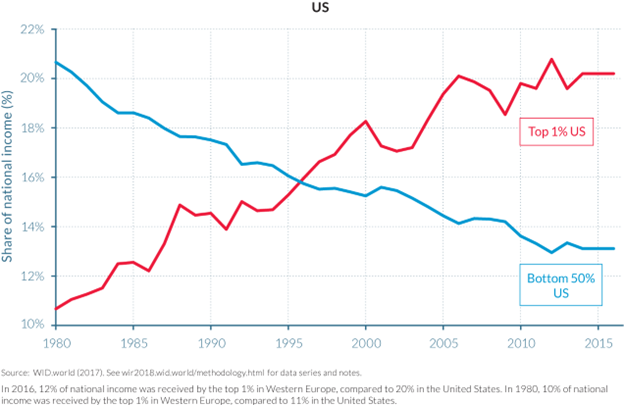

The 99% who are not rich have not benefited from the policy settings of the last 40 years, practically all benefits created by the dramatic policy changes of the neoliberal era have gone to the rich (the top 1% and especially the top 0.1%).

At the heart of these changes were two myths, 1) the free-market myth and 2) the ‘government as a household’ myth.

The free-market myth was invented by obliging economists to favour corporations and their wealthy shareholders. It was construed that keeping government ‘out of business’ and out of individual’s lives would create greater prosperity and ‘progress’ (whatever that is).

The soundbites that go with this myth are outsourcing as opposed to public service and cutting ‘red tape’ and ‘green tape’, i.e. reducing government regulation and oversight. This approach vastly favours those who have access to better resources – more money, better lawyers, access to lobbyists and politicians, more autonomy over where they live etc.

The flip side of the ‘free market is good myth’ is that ‘government is bad’ and hence politicians should not act as legislators and regulators, but as enablers. Government should not provide services itself; it should enable entrepreneurship and private enterprise. The only problem with this bullshit is that politicians, and voters, have come to believe it.

Politicians have bought into the myth and started curtailing their and their constituents’ ambitions for a healthy and sustainable world. Under the constant pressure from a compliant corporate media, think-tanks and lobbyists they have stepped back from taking care of the national interest. And today, if you want access to power, you have to toe the line – less government, less taxes, less regulation.

The same economists conveniently invented the second myth – that government budgets are like household budgets. This utter nonsense has been surprisingly easy to sell to voters who know how a household budget works but lack the time and interest to investigate the intricacies of government operations beyond the official narrative.

The reason that this is a myth is because, in reality, governments don’t spend ‘taxpayer’s money’. Any money a government spends it creates into existence by virtue of being the creator and backer of the national currency (assuming your country has one).

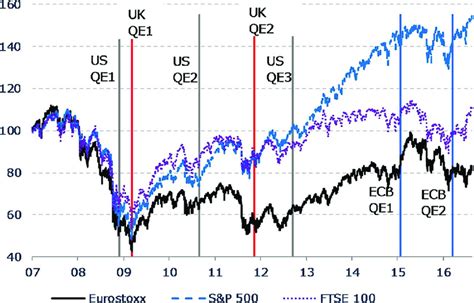

This holds irrespective of the fact that most governments borrow from financial markets and that most new money is created by commercial banks when they write new loans. These are technicalities that do not change the fact that governments, who are currency sovereigns, can create money in domestic currency at will. They did so during the recent pandemic, they just called it quantitative easing and stimulus spending. Japan has been doing this for over 30 years and nothing ‘terrible’ (hyperinflation, debt crisis) has happened.

So, let’s circle back to the beginning. If issuing money is not the limiting factor on politicians and government spending, what limits a government’s ability to create prosperity for all? In the end, what matters is what that domestic currency can buy you. To create prosperity, governments need to be able to access resources (energy, minerals, water, arable land, labour) and they need access to foreign currency when these resources cannot be sourced domestically. What is happening today is that government are increasingly constrained by resource limitations.

If, like Germany, you have an ageing population and you can’t sell mass immigration to your voters, then it does not matter that you could conjure up billions to, say, convert all domestic heating to heat pumps so you no longer have to buy Russian gas. Germany runs a trade surplus, so even if domestic industry can’t make the heat pumps (which it could), Germany could easily afford to buy them from abroad. What Germany can’t conjure up are some 250,000 qualified plumbers and electricians that would be needed to install the heat pumps and not even the fabled single market in the EU can supply those anymore since the working age population has been declining in the EU since 2008.

Seen in this light, politicians instead resorting to quantitative easing is entirely logical. The money goes from the central bank straight to commercial banks which in turn lend it to business to buy back their own shares and to investors, who buy shares. That increases share prices as can be seen above but has no resource impact. Or the banks make real estate loans, which inflates prices but it doesn’t change the number of properties built in the short term.

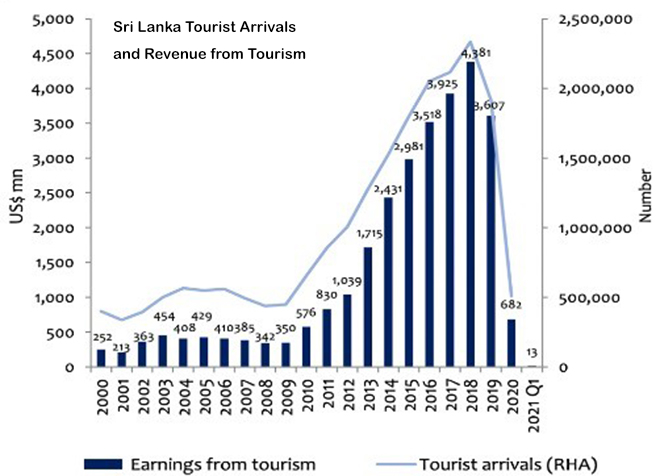

Another example of how this plays out in practice can be seen in Sri Lanka. After the loss of foreign tourism revenue due to the Easter bombings followed by the pandemic Sri Lanka could no longer pay for oil and fertilizer imports.

Foreign loans dried up as the ability for Sri Lanka to pay them back was clearly no longer there. Faced with severe resource limitations the populist government of the Rajapaksa brothers promised tax cuts and increased handouts to citizens to win the election; and yet they could do nothing to prevent the collapse. Without oil, the economy stopped.

This means we currently have two dominant patterns that result in ‘inept politicians’, 1) the ideological, self-imposed limits on what government can do and pay for to stay true to the neoliberal playbook and 2) the real resource limits constraining what a government can do and pay for. These two patterns are not mutually exclusive, they work in combination, which provides a convenient excuse either way when nothing is achieved.

These ideological and real constraints mean we should not be too surprised that populations have lost trust and faith in government. And the elites don’t mind, this belief that governments are inept conveniently reinforces the ‘free-market’ myth. As expectations on politicians decline, miniscule ‘achievements’ like the pandemic handouts can be sold as massive political wins. Deteriorating infrastructure and poor or expensive public services (usually outsourced) are accepted with a shrug and some venting on social media.

Politicians learn that they win elections not by keeping promises to the wider population, but to their key supporters and donors who represent the interests of the rich. They learn that elections can be bought, and that people can be easily placated. Politicians probably know the endpoint of ignoring the needs of the broader population will be civil unrest, so it should come as no surprise that they are preparing for this with new legislation to fine and jail even peaceful protesters.

Our work is entirely reader-supported, so if you enjoyed this article please consider sharing it around, following us on Twitter or LinkedIn, or throwing some money into our tip jar on Paypal. Everything we publish is open access. Finding the time to do the research and writing is helped by the goodwill of people who are also looking for real answers to what is happening. The best way to make sure you don’t miss the articles we publish is to subscribe to the mailing list at our website.

Peter Lanius is a physicist by training who has worked in IT, Telecoms and as an executive coach across many industries. He believes in collapsing early to avoid the rush and lives on a 20acre property in regional Australia.