Broken Systems – Corporate Criminal Justice Has Never Existed

Over recent years there has been an ever-growing dialog about how to deal with the transnational, organised crime associated with the trade in endangered species and environmental goods.

As the legal and illegal trade in endangered and exotic species are so intertwined that they are functionally inseparable, some time ago I found myself exploring why so few inroads have been made in dealing with this transnational organised crime. One question I started considering more-and-more was, could the reality be that there is just too big an overlap between transnational organised crime and white-collar/corporate crime for any progress to be made? And, given that there is so little appetite to deal with white-collar/corporate crime, does this mean that nothing decisive can be done in dealing with transnational organised crime?

As I dug into these questions, a paper published in 2021 explains why the situation was even worse than I had considered. Its title says it all, But We Haven’t Got Corporate Criminal Law!

The paper’s abstract (shown) explains why the environment is in the dire situation it is today – “The real question is not whether the United States should retain corporate criminal law, but what would it take for the United States to have a corporate criminal justice system in the first place.”

While this paper covers the USA, the same is true around the world, one reason being that many of the laws, in countries of the historic British Empire, go back to and are based on the Magna Carta; ‘punishing’ business is almost exclusively based on fines.

Fines levied against corporations are not paid by executives or directors, they are paid by Accounts Payable, simply becoming a cost of doing business. They may make a brief dint in the next quarterly results and are then quickly forgotten.

But even with this very low benchmark, you have to start somewhere, right? So, in this respect, I was delighted to read an article in The Guardian recently describing how lawyers are turning their attention to cases that address the loss of biodiversity. The article quotes Zaneta Sedilekova, a lawyer at Clyde & Co, who thinks biodiversity litigation will go through a similar arc to its climate counterpart, with campaigners targeting countries first and then companies. Sedilekova admits it is still hard to persuade businesses that biodiversity litigation is a real risk, but argues that it could be a powerful tool to change corporate behaviour. “The importance of litigation is to not turn one ship around, but to set a precedent so that others don’t wait for it to happen to them.”

A key paragraph in the article, was, “The more supply chain data we have, the easier it will be to trace that ecosystem damage to a jurisdiction which has fast and efficient judicial service or judicial provision which is not corrupted, and where the defendant has a lot of money.”

This paragraph perfectly explains why the CITES regulator has not yet been modernised. While the supply chain for CITES listed products remains opaque it is easy for companies to maintain plausible deniability about illegal products entering their supply chains, particularly near the ‘raw materials’ end of the value chain.

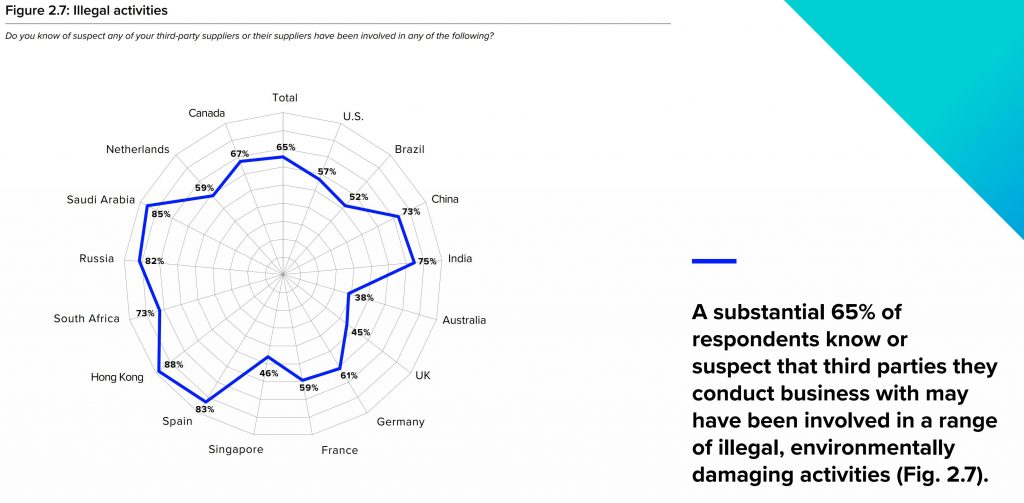

Companies are aware of illegal products entering their supply chain as a 2020 report on green crime confirmed. Refinitiv (one of the world’s largest providers of financial markets data serving, over 40,000 institutions in 190 countries) conducted the survey and wrote the report, which highlights the scale of supply chain risks going unreported and undetected. The survey revealed that just 26% of respondents are knowledgeable about environmental crime and its associated risks. Of those who were aware:

- A substantial 65% of respondents know or suspect that third parties they conduct business with may have been involved in a range of illegal, environmentally damaging activities.

- Only 16% of respondents say that they would report a third-party breach externally

- Only 53% said they would report it internally.

- Critically, 63% of respondents agree that the economic climate is encouraging organizations to take regulatory risks in order to win new business.

It is the absence of corporate criminal justice law that enables this behaviour.

That much business behaviour today is neither ethical, moral or sustainable in any industry is hardly news to observers of corporate conduct. Beyond this universal lack of sustainability, far too much corporate behaviour is plainly illegal.

Corporate (white-collar) crime is widespread, massive in scale and totally and deliberately ignored by governments and their law enforcement agencies. You can go to jail for many years for stealing from a convenience store, but nobody goes to jail when companies steal billions. Unsurprisingly then that the total scale of corporate criminal conduct is unknown; this is also the case in Australia.

The best estimate from the US is that only 5% of corporate crimes ever come to light. So, it comes as no surprise that while 8.6% of the adult population, in the USA, has a felony conviction, less than 0.03% of corporations do. This is not because corporations are somehow much better behaved than the individuals who compose them. A 2019 publication, The Frequency of Corporate Misconduct: Public Enforcement versus Private Reality, showed that large corporations commit on average two incidents of major financial crime each week.

All this makes it immediately clear that in the absence of meaningful consequences there is a high incentive for corporate criminals to continue with their behaviour.

In finishing, let’s go back to a statement in the abstract of the paper, But We Haven’t Got Corporate Criminal Law!

“The abolitionists won long ago… through craftiness rather than force of reason. By arguing that the United States should get rid of corporate criminal law, abolitionists have staged a debate the presumes corporate criminal law in fact exists. It does not, and it never has. The greatest trick the abolitionist ever pulled was convincing everyone to think otherwise and then duping their opponents into arguing for the status quo.”

I am encouraged that lawyers are turning their attention to cases that address the loss of biodiversity. It is often the judicial systems in countries, and not politicians, that drive the changes needed.

To support this change, as a society we must ask ourselves, “Will we continue to let corporations stand in the way of modernising international governance and law?”; this question also goes to corporate conservation agencies.

Will these global conservation organisations be a catalyst to speed up this change or will they continue to enable corporations to behave badly by supporting voluntary governance and certification schemes instead of lobbying for legislation and regulation to corral corporate behaviour? If businesses are not held accountable by governments and civil society, why should we be surprised that they prefer corporate greenwashing over meaningful action?

Our work is entirely reader-supported, so if you enjoyed this article please consider sharing it around, following us on Twitter or LinkedIn, or throwing some money into our tip jar on Paypal. Everything we publish is open access. Finding the time to do the research and writing is helped by the goodwill of people who are also looking for real answers to what is happening. The best way to make sure you don’t miss the articles we publish is to subscribe to the mailing list at our website.

Lynn Johnson is a physicist by education and has worked as an executive coach and a strategy consultant for over 20 years. In her work she pushes for systemic change, not piecemeal solutions, this includes campaigning for modernising the legal trade in endangered species, to help tackle the illegal wildlife trade.