Insurance Could Be The First Casualty Of Collapse

It would appear that we have entered the crisis stage of our current ‘secular cycle’ around 2019. According to Turchin and Nefedov after the initial growth phase, which lasted around 100 years to the mid-1970s, we had 45 years of little or no real (per-capita) growth, the stagflation phase. For the last few years, we have seen clear signs of the crisis stage – a global pandemic, a major war, suppression of democratic rights, supply chain shocks, energy shortages and rolling blackouts, cyber-attacks, increased climate change related catastrophes paired with inept responses by governments to the rapidly changing circumstances.

The increased risk and frequency of catastrophic losses to human life, agriculture and infrastructure could make the insurance industry the first casualty of the collapse. Offering insurance relies on the predictability of risks and adverse events and on the ability of customers to pay the premiums to insure against such risks. When the equation no longer stacks up, insurance companies will refuse to offer products, or they will include more exemptions. This has already long been the case for nuclear reactors, since Chernobyl such reactors have become uninsurable due to the potential scale of losses from such accidents.

Insurance cover already tends to exclude many eventualities that were mentioned above – such as acts of war and pandemics. These will increase in frequency during the crisis stage, as will climate change related catastrophes. Losses due to climate change have topped US$100 billion in 2022 for the second year in a row and things are going to get worse rapidly once we cross 1.5 degrees warming in 5-10 years’ time.

The bomb cyclone in the US over Christmas is a good example of how this plays out. Temperatures dropped up to 40 degrees in a matter of days because cold artic air made it all the way down to Texas. This results from changes in the Northern Jetstream, it ‘meanders’ instead of providing a strong barrier between the cold artic and continental climate in the Northern hemisphere. The temperature difference between the artic and the Northern continents is declining fast as the artic is warming twice as fast as continental climates. This reduces the stability of the Jetstream, and it starts meandering, causing more frequent bomb cyclones which in turn cause higher insurance losses due to electricity and gas outages, snow damage, bursting pipes etc.

The COVID pandemic is another good example of how insurance will be impacted. Long COVID is caused by or correlated with auto-immune related effects, with many sufferers unable to work. COVID reinfections correlate with a doubling in all-cause mortality and tripling the risk of hospitalisation and a range of other serious illness. This will lead to large increases in both life insurance and health insurance claims associated with the pandemic entering its fourth year now.

Another example is cyber-attacks. The CEO of Zurich Insurance told the Financial Times that cyber-attacks might become uninsurable even before pandemics and climate change related catastrophes. The article describes the impact on insurers and their response: “Spiralling cyber losses in recent years have prompted emergency measures by the sector’s underwriters to limit their exposure. As well as pushing up prices, some insurers have responded by tweaking policies so clients retain more losses. There are exemptions written into policies for certain types of attacks. In 2019, Zurich initially denied a $100mn claim from food company Mondelez, arising from the NotPetya attack, on the basis that the policy excluded a “warlike action”. The two sides later settled.”

It would be good the recall in this context that cyber-attacks are increasingly the result of state-based actions, so it should not be a surprise that the sector is looking to exclude state-based attacks from cover. To make matters worse, we have already seen examples of malicious software developed by state-based actors making their way into private hands, the Vault 7 leak would be one example. With the war in Ukraine the US and its allies have been providing cyber-attack tools to Ukraine, a country known as the most corrupt in Europe. How long before these tools are on-sold on the dark web?

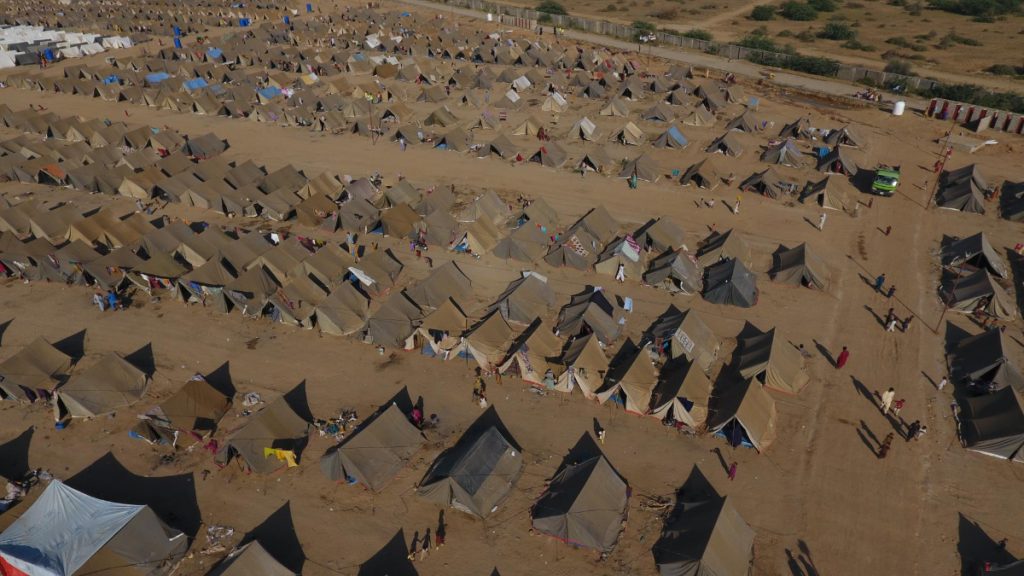

The hallmark of the crisis stage is that there is no going ‘back to normal’. During the crises stage governments become less effective in managing risks and containing threats. The scale of losses reaches a point that can no longer be matched by available resources (labour, energy, manufactured goods), even if government action was prompt and efficient (which it is not). The recent floods in Pakistan affected 33 million people, displaced around 8 million and destroyed over 1 million houses. Given that the vast majority of homes and businesses were uninsured, the burden of estimated reconstruction costs of US$16 billion falls on the government. Yet Pakistan is a country with famously low tax revenue and government capability. The reconstruction costs are equivalent to half the total government spending in 2021!

As adverse events and claims continue to increase, the insurance industry will be faced with just a handful of choices, either withdraw coverage or lift premiums to match the risk. The latter option reduces the number of policies taken out, which further increases premiums, so the industry tends to opt for exemptions or withdrawing coverage instead. At some point in the near future insurance cover will either become meaningless due to the number of exemptions or disappear altogether. In many storm- or flood-prone areas getting insurance is already beyond the means of home- and business owners. For example, the percentage of uninsured homes in Northern Australia ranges from 17% in Northern Queensland to 40% in Northern WA.

Not having insurance or having cover that is littered with exemptions will severely undermine the relative comfort of Western lifestyles. Certainty and peace of mind are major selling points that underwrite our addiction to debt and property. Once the belief in a predictable future goes up in smoke, so does debt-fuelled consumption.

Peter Lanius is a physicist by training who has worked in IT, Telecoms and as an executive coach across many industries. He believes in collapsing early to avoid the rush and lives on a 20acre property in regional Australia.