Don’t Let Your Retirement Fund Drive The Extinction Crisis

Like many people, you may want to ensure the funds you are setting aside for your retirement aren’t being invested in companies driving the extinction crisis or global warming.

Yet it is hard for individuals to deep dive into companies and research their supply chains. We have to rely on the investment fund managers, including those managing our retirement funds to find this information on our behalf. The organisations managing our investments are increasingly selling us their strong commitment to environmental, social and governance (ESG) issues. But what does this really mean?

Ken Pucker and Andrew King are leading voices questioning the integrity of ESGs. Ken Pucker, former Timberland COO and lecturer at Tufts University and Andrew King, chair of the Questrom School of Business at Boston University, are becoming the go to people for clarity on ESGs. Together, they are pulling no punches in laying bare the facts.

In their article, ESG Investing Isn’t Designed to Save the Planet, published this month in Harvard Business Review, they clearly state,

“Most people assume that ESG Investing is designed to reward companies that are helping the planet. In fact, ESG ratings which underlie ESG fund selection are based on “single materiality” — the impact of the changing world on a company P&L, not the reverse. Asset management firms have been happy to let the confusion go uncorrected — ESG funds are highly popular and come with higher management fees. The danger with ESG investing is that it might convince policy makers that the market can solve major societal challenges such as climate change — when in fact only government intervention can help the planet avoid a climate catastrophe.”

So, if asset management firms are complicit in not correcting their customers’ confusion about ESG investing, because they are profiting from the higher management fees connected with ESG funds, then isn’t this is just another form of greenwashing?

In a February article for Institutional Investor, ESG and Alpha: Sales or Substance? Pucker and King outline their conclusions from a series of confidential interviews with industry practitioners,

“We learned that the logic and evidence for assurances of ESG-driven alpha are lacking. Indeed, it is our best guess that flows of money into ESG funds represent a marketing-induced trend that will neither benefit the planet nor provide investors with higher returns — but might defer needed government regulation.”.

Clearly investors cannot view ESGs through rosed coloured glasses when they read reports such as Biodiversity, Unlocking natural capital value for Australian Investors. This report, published in 2021, was commissioned by the Australian Council of Superannuation Investors (ACSI) and prepared by consultants EY.

In the foreword, ACSI’s CEO, Louise Davidson, clearly states what ESGs are all about, “Biodiversity loss is an emerging ESG issue, with Australian investors seeking to understand how to manage and address the financial risks to businesses they invest in.”. No confusion there, ESG investing is about managing investment risks not about saving the planet. And Australian investors have more reason than most to be worried about risks to their domestic investments. A report by Swiss Re, the world’s second-largest re-insurer ranked Australia in second (worst) place for failing and fragile ecosystems of the G20 countries.

While the focus on biodiversity loss is long overdue, are ESG investing and projects simple another illusion of an ‘effective’ system, whilst basically doing nothing that would impede growth or profits? Until there is genuine evidence of real substance that ESG initiatives are tackling biodiversity loss they aren’t much more than virtue signalling.

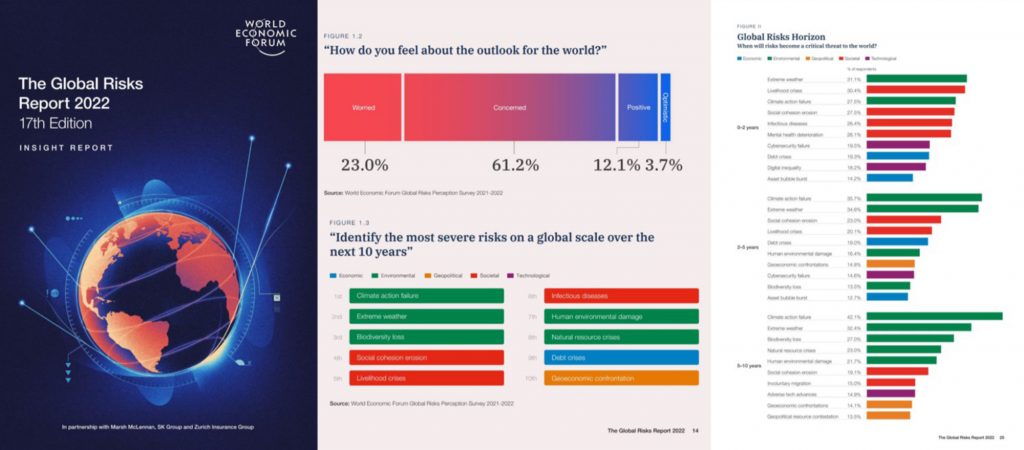

What is clear is that we do need something to happen quickly to reverse the extinction crisis that poses a very real risk to our children and grandchildren. This urgency was reflected in the World Economic Forum 2022 Global Risks Report, where environmental risks, both short term and long term, dominate the report.

The report summarises the results of a WEF survey of business leaders, politicians and academics, basically the people who they expect to come to the WEF Forum in DAVOS. More than 84% of people surveyed are worried or concerned about the outlook for the world. Just 12% have a positive view and less than 4% reported feeling optimistic. “Most respondents … expect the next three years to be characterized by either consistent volatility and multiple surprises or fractured trajectories” WEF said.

For investors who want their retirement funds to make a real difference in reversing biodiversity loss, it is time to ask those who manage your funds to prove that ESG investing is not just another form of marketing-induced greenwashing.

Our work is entirely reader-supported, so if you enjoyed this article please consider sharing it around, following us on Twitter or LinkedIn, or throwing some money into our tip jar on Paypal. Everything we publish is open access. Finding the time to do the research and writing is helped by the goodwill of people who are also looking for real answers to what is happening. The best way to make sure you don’t miss the articles we publish is to subscribe to the mailing list at our website.

Lynn Johnson is a physicist by education and has worked as an executive coach and a strategy consultant for over 20 years. In her work she pushes for systemic change, not piecemeal solutions, this includes campaigning for modernising the legal trade in endangered species, to help tackle the illegal wildlife trade.